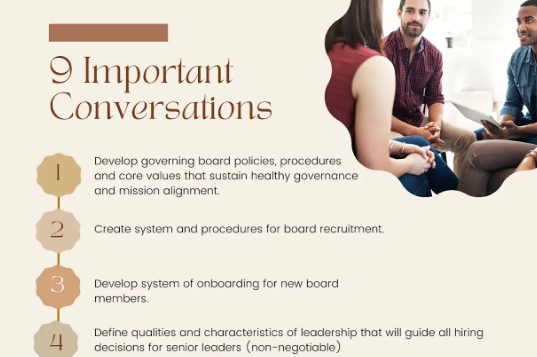

This article can help organizations seeking to comply with ECAP Standard 1: Governance. We believe effective child protection starts at the top, with an organization’s leadership. If the board does not understand and embrace a ministry of child safety, the rest of the organization will not be able to protect children from abusers or respond adequately to allegations of abuse.

From our friends at Wagenmaker and Oberly.

https://www.wagenmakerlaw.com/blog/directors-e2-80-99-and-officers-e2-80-99-duty-care-e2-80-93-pay-attention-and-take-responsibility

You’ve been asked to serve as a nonprofit director or officer, or perhaps you are already doing so. What legal responsibilities do you take on as a director or officer? In legal terminology, these responsibilities are known as “fiduciary” duties, the first of which is the duty of care.

The Basics of Fiduciary Duties

The term “fiduciary” is based on the Latin word for “trust.” Being a fiduciary means being entrusted with accountability for an organization’s well-being. Leaders of not-for-profit organizations serve as stewards of organizations’ assets and other interests. Because charitable assets are intended for public benefit, they belong to no private person and thus must be guarded carefully for the public’s interest. The generic name for this guardian role is “directors,” but other titles may be used instead (e.g., “trustees”). Officers also have specified responsibilities for governing not-for-profit organizations, and their titles may vary similarly. Whatever the title, directors and officers are entrusted with taking care of their nonprofit organization.

Directors and officers of not-for-profit organizations are generally held to the same standards of care as directors and officers of business corporations. They are responsible for overseeing programs, finances, employees, and the vision of the not-for-profit organizations they serve. In nonprofits, directors and officers contribute their time, talents, and treasures to worthwhile causes through involvement in meetings, fundraiser events, and special committee work. Nonprofits cannot survive without the sacrificial dedication of these leaders, but the leaders must do their jobs – hopefully well!

Fiduciary Duty of Care – Paying Attention (In Many Areas!)

The duty of care requires directors and officers to exercise reasonable diligence and due care in conducting the not-for-profit’s affairs. At a minimum, they must stay informed about the activities and finances of the organization by regularly attending corporate meetings, actively examining and evaluating the records made available to them by staff, and understanding how the organization functions under its bylaws. Board members must act in good faith as they make decisions and seek always to avoid the misuse or waste of its assets. When a decision involves complex matters, the board should engage subject matter experts, community representatives, and professional advisors if the directors lack the requisite skills to make an informed decision.

The duty of care is generally evaluated according to the “business judgment rule,” under which directors and officers are presumed to make decisions on an informed basis and in good faith. Accordingly, to stay within the business judgment rule’s protection, directors and officers must take the same care that an ordinary and prudent person would exercise under similar circumstances. Failure to exercise such care through gross negligence or willful misconduct may result in personal liability. The following paragraphs describe the best practices for directors and officers to fulfill this duty, with numerous and extensive parameters.

1. Active Oversight Through Board Participation

Responsible directors and officers exercise active oversight through participation in board and committee meetings, preparation for them, and follow-up work. Directors and officers must stay informed. The law will not excuse a director’s culpability based merely on his or her absence from board meetings. In fact, the duty of care requires regular participation in board meetings. Directors and officers are responsible for the not-for-profit organization’s decisions and activities, whether he or she was present or absent at any particular meeting.

Minutes of each board and committee meeting should be recorded in writing and maintained in a central, safe location. The written minutes should clearly express the board’s or committee’s intentions. Ideally, minutes should be sent to all directors and officers shortly after each meeting so that they can review the minutes while their memory is fresh. All minutes (for board and committees) must be reviewed at the next meeting of the board and expressly approved.

For significant board actions, written resolutions should be prepared, signed by the corporate secretary, and maintained with the corporation’s official minutes. Assistance of legal counsel may be appropriate to ensure that the resolution is legally sufficient to accomplish the board’s intentions. Depending on the type of resolutions, the board may need to follow up with staff or others to assure proper implementation.

Directors and officers should also be familiar with their organization’s bylaws, other corporate documents, official policies, and reporting obligations. The board also should be knowledgeable about the organization’s reporting responsibilities including payroll tax liability, other employment-related obligations, and its annual IRS Form 990 information return obligation (which varies depending on the organization’s revenues and assets).

2. Reliance on Outside Counsel

Directors and officers may not relinquish their duty of care. Often, however, they may delegate limited responsibility to committees or persons to investigate a matter, carry out a project, or advise them on an important question. For example, board members rely daily on executive directors to manage staff and financial matters, they periodically hire attorneys and accountants for their specialized areas of expertise, and they may appoint a special committee to develop plans such as for a fundraising event. In these situations, directors and officers must confirm that the persons or groups are competent in their respective areas and can be expected to act responsibly. As long as the directors and officers use reasonable care in delegating to others and rely on them in good faith, the directors will fulfill their legal duty of care.

3. Maintenance of Corporate Property

When a not-for-profit corporation owns or controls real estate, automobiles or other property that could be involved in causing personal injuries, the directors should take care that such property is properly maintained in order to protect others from harm. In addition, directors should ensure adequate insurance exists to cover the proper corporate entity, in sufficient amounts, and with appropriate types of coverage. These matters are particularly important if the organization invites the public into its facilities.

4. Supervision of Charitable Services

When a not-for-profit organization provides services to the public, its directors and officers must verify its workers are reasonably competent enough not only to provide the services but to ensure that services themselves are appropriately managed. For example, it may be great to offer bungee jumping to summer campers (i.e., the services), but not without sufficient training for the staff in charge as well as very careful checking for all equipment involved (the management). Screening for workers, employees, and volunteers is recommended. Depending on the services and responsibilities, appropriate screening may include criminal background checks, reference checks, credit checks, personal interviews, and follow-up investigations regarding questionable information. In recent years, criminal background checks have become so inexpensive that failure to do them may amount legally to gross negligence, and therefore potential personal liability of directors and officers, especially in cases involving vulnerable persons such as children.

In addition, directors and officers should make sure that the organization’s employees are appropriately supervised in the performance of their work. If not, the organization could be held liable to others under legal theories of negligent hiring or supervision of employees. Volunteer directors could also be held personally liable in instances of gross negligence, such as harm resulting from a known convicted sex offender being employed to work with children. The organization and its volunteer directors could likewise be held liable if the leadership becomes aware of facts indicating that it is no longer safe for an employee to continue his or her duties.

All of these precautions thus should be part of an effective and helpful risk management plan to protect a not-for-profit organization, its workers, and others with whom it comes in contact.

5. Employment Practices

Employees are typically among a not-for-profit organization’s best assets, and yet the potential liability associated with employees is significant. Disgruntled or injured employees who assert employment-related claims – even if unfounded – can cause great expense, distraction from an organization’s mission, personal liability, and damage to an organization’s or individuals’ reputation. Not only can their harm to others cause liability to a not-for-profit (and even personal liability to its leaders in cases of gross negligence), they are protected by a myriad of complex and varied employment laws that provide for private rights of action, government intervention, and even punitive damages and criminal penalties under certain laws.

While as a matter of board governance directors should not directly supervise an organization’s employees, they nevertheless should hold the executive director and other key leaders accountable for complying with employment laws and treating employees fairly. Accordingly, directors and officers should carefully oversee employee matters through adopting sound personnel policies, following them consistently, hiring high-quality supervisors (including a human resources manager for larger organizations), treating employment problems as confidential, and seeking legal counsel as appropriate such as in cases of employee terminations or grievances.

6. Responsible Financial Management

Directors and officers owe a legal duty to responsibly manage their not-for-profit organizations’ charitable assets. This means that they may not allow waste of charitable assets, improper conflicts of interest, or other misuse of charitable funds.

Internal financial controls prevent loss from employee error, mismanagement, and fraud. Good internal controls include specific directives such as how money is deposited and disbursed, accounting for petty cash, and authorization for check-writing and expenditures limits. In essence, these functions should be segregated between custody (of assets), recording (transactions affecting assets), and decision-making authority (over the use of assets). When properly instituted, these controls should prevent loss by developing systems that will uncover employee error, mismanagement and fraud at an early stage. An annual audit by an independent auditor is an excellent method of testing the effectiveness of an organization’s internal controls. The board should oversee the audit engagement, meet with the auditor at its conclusion, and supervise the completion of all corrective tasks identified in the auditor’s management letter.

In addition, it may be prudent for organizations with an endowment or other reserve funds to develop a board-approved written investment policy, to provide guidelines for investment of the organization’s charitable assets. A spending policy may be helpful as well, to address the extent to which an endowment fund’s net income and principal may be spent for a nonprofit’s operational expenses.

Looking at a particular case may help illustrate how financial responsibility directly affects a nonprofit organization. In the key case of Stern v. Lucy Webb Hayes National Training School (D.C.D.C. 1974), the court ruled that the directors had breached their fiduciary duties in allowing hospital assets to be grossly mismanaged. The court therefore held them responsible for repaying lost charitable funds. In that case, some directors had willfully and perhaps intentionally mismanaged certain funds for personal gain. Others simply failed to exercise the requisite care to supervise investments and expenditures, but they were also held liable for the mismanagement. Notably, the directors’ laxness in allowing large sums of money to be held in checking accounts, rather than being invested, amounted to a breach of their duty of care. A key factor was the directors’ overall abdication of oversight responsibility to a few directors, who managed the charitable assets under clear conflicts of interest.

Some states also may have stricter requirements regarding financial responsibilities within a director or officer’s duty of care. Notably, trustees of charitable trusts in Illinois operate under a more stringent standard known as the “prudent investor” rule. Specifically, under the Illinois Trusts and Trustees Act, each trustee has the “duty to invest and manage the trust assets as a prudent investor would considering the purposes, terms, distribution requirements, and other circumstances of the trust” (See 760 ILCS 5/5(a)(1). This standard requires “reasonable care, skill, and caution.” Accordingly, it is often appropriate to consult with outside professional advisors who are knowledgeable and competent in financial investment matters. The Trusts and Trustees Act specifically permits trustees to delegate investment functions, so long as the certain requirements are satisfied such as the exercise of care, skill and caution in selecting and overseeing an investment agent (760 ILCS 5/5.1(b)(1), (2), & (4)).

7. Duty to Withhold, Collect and Remit Income Taxes, Unemployment Insurance Contributions, and Sales Taxes

Federal and state tax laws require employers to withhold income taxes from employee wages and remit them to the government. Under Internal Revenue Code sections 6321 and 6672, the managers who make decisions concerning corporate expenditures may be personally liable to pay employment taxes out of their own pockets if the corporation is unable to do so. Specifically, section 6672(a) imposes a 100% penalty, in addition to any other nonpayment penalties for “[a]ny person required to collect, truthfully account for, and pay over any tax imposed by this title who willfully fails to collect such tax, or truthfully account for and pay over such tax, or willfully attempts in any manner to evade or defeat any such tax or the payment thereof.” Under Code section 6672(e), liability may be imposed on volunteer board members who have actual knowledge of organization’s failure to pay taxes or participate in organization’s financial operations.

Similarly, some state laws (e.g., Illinois) allow board members to be held personally liable for failure to collect and remit state unemployment insurance contributions and state sales taxes. The board of directors thus should take these responsibilities very seriously. Even when an organization’s finances are tight, directors must ensure that the government is sent all withheld employee taxes. There should be no exceptions to this policy. No immunity statutes protect directors and officers from this liability.

8. Loans to Corporate Directors or Officers

Generally, directors and officers have no authority to approve loans of corporate funds to themselves. Such transactions create a perception of self-dealing and, unless they conform in every respect to commercial terms, violate the duty to care for the management of not-for-profit funds. Such loans may also create a conflict of interest, i.e., a violation of the duty of loyalty as described below. As with many state laws, the Illinois Not-for-Profit Corporation Act permits such loans only under very special circumstances. Notably, it also provides that every person participating in the making of such a loan remains jointly and severally liable to the not-for-profit corporation for its unpaid balance until it is repaid. In addition, federal law absolutely prohibits private foundations from making such loans. (See I.R.C. § 4942 (self-dealing)).

9. The Sarbanes-Oxley Act: Document Retention and Whistleblower Policies

The Sarbanes-Oxley Act of 2002 is directed at improving financial accountability of large, publicly traded corporations. Two provisions apply to not-for-profit organizations as well.

First, under the Act, it is a crime to knowingly alter, destroy, conceal, or falsify any record or document with intent to impede, obstruct, or influence a federal investigation or the administration of any other federal matter. Penalties include fines and up to 20 years imprisonment. Not-for-profit organizations should adopt and follow a record retention policy to promote compliance with applicable legal requirements.

Second, persons who report financial misconduct by an organization, its leaders, or its employees enjoy legal protection if such information relates to the commission of a federal offense and is reported to a law enforcement official. Retaliation against such whistleblowers may result in fines of up to $10,000 and imprisonment of up to 10 years. The scope of this provision is broad, covering “any action harmful to any person” that is done “knowing[ly], with the intent to retaliate.” As part of their duty of care, directors and officers thus should adopt and follow whistleblower policies that set forth procedures for reporting allegations of wrongdoing.

10. Contracts

As a matter of corporate law, those persons who act with actual or apparent authority may bind the not-for-profit corporation to perform contractual obligations. Accordingly, directors and officers should carefully monitor its representatives, communicating to them clearly their scope of authority and circumscribing their authority when necessary. In addition, the corporation’s bylaws should contain financial policies requiring board approval for certain transactions (such as loans) and for expenditures over certain limits. The bylaws may also require dual signatures for checks in excess of certain limits or other transactions.

When signing any contract or other agreement on behalf of a not-for-profit organization, directors and officers should be careful to identify in writing that they are signing in their board capacity and not individually (e.g., “Save the World, By John Smith, President.”). In this way, the board member will bind the organization but not themselves personally.

11. Publications and Other Statements: Avoiding Defamation Liability

Directors and officers should take care that writers and editors of all organizational publications exercise responsibility for their written content. Highly motivated advocates sometimes fail to exercise good judgment when writing about adversaries. The potential for publishing slanderous or libelous statements increases when a not-for-profit is involved in controversial issues. If a nonprofit begins to publicly identify their adversaries with names like “loan sharks” and “predators,” it is quite probable that these very people will be the first in line to sue for libel or slander. Directors, officers, and staff should likewise exercise caution in speaking about their organization, its friends, and its enemies. With respect to sensitive matters, such as a claim of sexual harassment, it is generally prudent to limit disclosures on a “need to know” basis to avoid potential defamation claims as well as to protect the confidentiality privacy of those involved.

12. Environmental Hazards

Directors and officers should take care in dealing with real estate, particularly property used for industrial purposes and other potentially pollutant activity. Under federal and state laws, liability may be imposed on owners of environmentally contaminated property. Consider a donor who seeks to transfer ownership of real estate that contains environmental hazards to a not-for-profit organization. If government officials later determine that the hazards are sufficiently dangerous, they may order the toxic substances to be cleaned up. Under federal law, regardless of whether the organization’s leaders were aware of this problem at the time of donation or purchase, the government may impose penalties and even cleanup costs on the organization. Many properties may be so tainted that it is not cost-effective to acquire them. In such cases, it may be best to look that gift-horse donor in the mouth and say “no, thank you.” At the very least, environmental inspections should be part of the due diligence process for potential real estate acquisitions.

Enforcement Mechanisms

As evident from the long list above, directors and officers owe numerous and important responsibilities to the nonprofits they serve that arise out of their fiduciary duty of care. How are directors and officers held accountable to others, in carrying out these responsibilities? Three sources of enforcement exist against leaders who breached their legal duties to the organization. The first lies with corporate members, officers and directors. These individuals may sue errant directors. Second, states’ Attorney General offices generally hold a wide range of legal powers to hold directors and officers accountable for improper governance and management. The third source of enforcement lies in the taxing authority of the federal, state and local governments. Laws pertaining to excessive compensation, self-dealing, employer tax withholding and retail sales taxes impose personal liability on corporate directors.

Conclusion

A nonprofit director or officer may feel overwhelmed at times by their numerous responsibilities, perhaps as a new leader or when problems develop. Overall, it’s best to keep these considerations in mind, stay attentive, and know when to bring in others assistance. Thankfully too, personal liability is the exception, not the rule, with both state and federal volunteer protection acts granting immunity in many instances. Additional considerations for potential personal liability lie beyond this article’s scope, but the moral is abundantly clear: the duty of care is not optional for nonprofit directors!

This blog post is part one of a three-part series on the fiduciary responsibilities of care, loyalty, and obedience.